Money in Cambodia: A Tourist Guide to ATMs, Cards and Exchange

This post may contain affiliate links. If you make a purchase using one of these links, I may receive a small reward at no extra cost to you. See my Disclosure Policy for more information.

Cambodia has the most confusing finances in Southeast Asia.

Officially the currency is Khmer Riel, but the US dollar is more commonly used, except for smaller purchases.

On the other hand, Cambodia is trying to de-dollarize and make people use the local Riel, but only half-successfully.

Withdrawing from an ATM with a foreign card, you still have the option to select US dollars. But only in big denominations, 100$ mostly ATMs now disperse 20$ and 100$.

To add to this massive confusion, border regions prefer neighboring currencies – the Vietnamese Dong and the Thai Baht instead of the Cambodian Riel.

Oh isn’t Cambodia a fun place when it comes to money? If fun=stressful, then yeah!

| Best foreign currency to bring | USD |

| Where to exchange? | Exchange bureaus, usually around markets |

| ATMs without a fee | None. |

| Can you withdraw USD | Most ATMs give you a choice between USD and KHR. |

| Can you use Revolut, Wise, Monese, etc? | Yes! |

| Cash or card? | Mostly cash |

Well, here is the full guide to money in Cambodia for tourists!

Currency in Cambodia

The official currency in Cambodia is the Cambodian Riel with the code KHR (short for Khmer Riel).

The Riel can be used for ALL purchases, big or small, in both cities and rural areas. It is the only official legal tender.

The banknote denominations of the Cambodian Riel are 50, 100, 200, 500, 1.000, 2.000, 5.000, 10.000, 15.000, 20.000, 30.000, 50.000, and 100.000. In practice, the 50, 15.000, and 30.000 are rarely used, whereas the 100.000 is only commemorative.

The second main currency in Cambodia, unofficially, is the US dollar.

The US dollar is not an official legal tender, but due to its stability and widespread global use (as well as local historical reasons covered later in the guide), it will be accepted in the majority of situations.

However, 2$ bills and USD coins will not be accepted. The same applies to older banknotes (issued before 2009) or those with any damage whatsoever.

There is an ongoing effort by the Cambodian Government to de-dollarize the country and use only Riel for smaller amounts (10$ or less). However, I found that all vendors and businesses will happily accept 5 and 10 USD bills and return change in Riel.

USD to Riel Exchange Rate

Officially, the Cambodian Riel is a floating currency, not pegged to the US dollar. It has fluctuated between 3950 and 4150 Riels to the Dollar in the past 5 years.

Once again, in Cambodia, what’s official and how things are in practice differ significantly.

Generally, the rate is 4000 KHR for 1 USD.

Almost all establishments and vendors will exchange 1 USD for 4000 KHR. The exception is convenience stores and big supermarkets, where the rate is closer to the market rate, now around 4100 KHR for 1 USD.

When to use Riel and when to use US dollars in Cambodia?

The rule I go by is: Use US dollars for anything larger than 5$ and Riels for anything below that.

Your hostel/hotel, tours, Angkor Wat ticket, a meal in a proper restaurant – use USD.

Street food, small purchases from a convenience store, markets – use KHR.

It’s more out of convenience than anything else – as mentioned already, both KHR and USD will be accepted for any amount. But paying, say 40$ (160.000 KHR), in small Riel notes, is annoying, and so is paying for a 2$ street food with a 50$ note which will put the vendor in a difficult situation regarding returning your change.

Exception – Visa on Arrival

Visa on Arrival for Cambodia costs 30$ and you must pay in US dollars in cash.

Not even Cambodian Riel (KHR) is accepted. It’s minty-fresh dollars ONLY!

You can mix dollars and riel!

Say you have to pay 13.50 USD.

Option 1: You pay 20$ and get 26.000 KHR back (6.5$ changed into Riel at a 4000:1 rate).

Option 2: You pay 10$ and 14.000 KHR

Locals do that all the time in their transactions. While in Cambodia, you will too. Just remember the 4000 KHR to 1$ rate.

You will always get small change in Riel! For example, if you pay with a 10$ note for something that costs 4$, you will get back ~24.000 KHR (6$ x 4000).

Dollar notes’ condition is ultra important

Update August 2024: A Government Directive was issued by the Cambodian Prime Minister requiring the Cambodian Commercial Bank to accept damaged USD notes.

Even though not part of the directive, other banks (such as ABA) have also followed suit and started accepting lightly damaged, torn, crumpled, or soiled dollar banknotes.

Moreover, ATMs will now start stocking 20 USD notes in ATMs in addition to the usual 100 USD.

In Cambodia, you can only use new dollar notes that are in pristine condition.

No damaged banknotes

Any US note with rips, tears, holes, marks, writings, or big creases will NOT be accepted by anyone!

If you are finding this a bit too much, let me explain. Cambodia does not print US dollars domestically. All the dollars come from outside. Thus, local banks cannot and will not exchange damaged banknotes. Which means that locals don’t want them either.

If you’re coming with fresh US dollar bills, this should not worry you too much. However, you should be extra vigilant when receiving notes! Locals may try to pass off their damaged notes to you and hope you don’t notice or don’t say anything. Simply demand different notes or to be paid back in Riel.

This does not apply to Riel notes – even if your banknotes are crumpled, torn, or looking like they’ve been through the washing machine inside your jeans’ pocket, they will probably be accepted.

Personal Experience

This is from before I knew much about money in Cambodia. I had to pay 3$ and I gave a 5$ bill. The vendor gave me back a 2$ bill. I didn’t think much of it.

However, nobody would take the 2 USD! Apparently, 2 dollar bills are seen as suspicious. I ended up saving it as a souvenir.

Moral: Don’t accept 2 USD bills in Cambodia.

New Dollars only

In addition to the very strict rules above, your dollars must be from recent issues. Specifically, your US dollars must be issued in 2009 or later.

A quick way to tell your dollars are new is to look at the portrait in the middle: old dollar bills have a small portrait in a circle, whereas new bills have a portrait without a frame.

Can you use your card in Cambodia?

Yes, you can use your foreign card to pay in some places in Cambodia.

You can pay by card in Phnom Penh and Siem Riep, perhaps Sihanoukville, Battambang, Kampot, and Kep too, but only in big hotels, restaurants, and supermarkets.

The standard commission for paying by card is 5%, except in supermarkets, where it’s usually without a fee.

That being said, Cambodia is still mostly a cash-based society. Smaller supermarkets, traditional open-air markets, family-run guesthouses, etc., only accept cash.

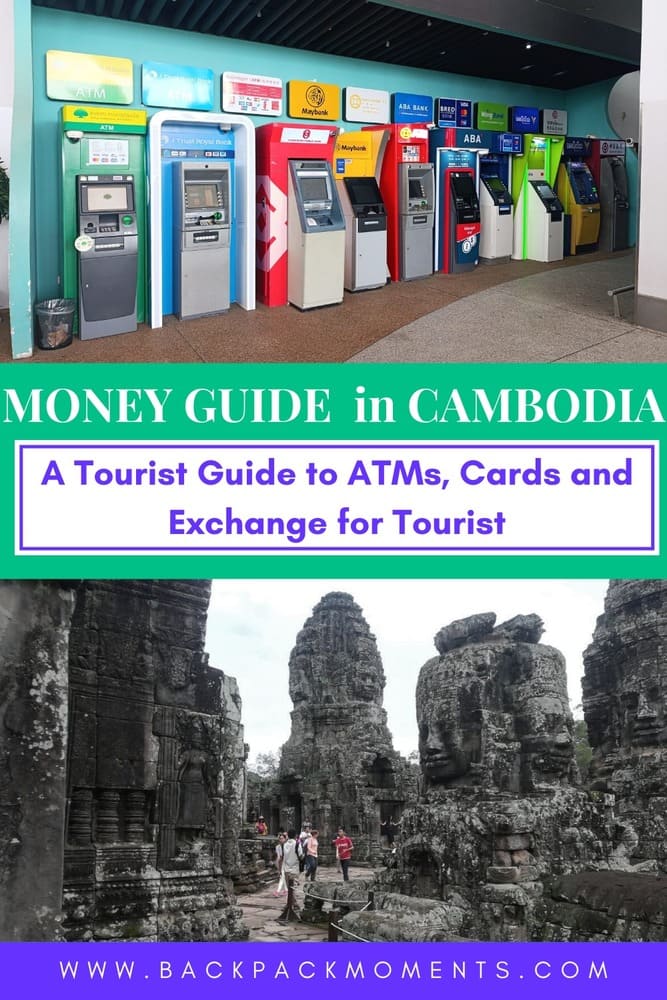

ATMs in Cambodia

There are so many ATMs in the big cities in Cambodia that you won’t have to walk further than the nearby intersection.

You may have problems finding an ATM in very rural areas, but in the nearby bigger town, there will surely be at least one ATM.

ATMs will almost always accept Visa and Mastercard. Some ATMs are picky and will accept one of the two but not both. For Maestro, AMEX, and the rest, you may have to try a few ATMs before you find one that accepts your card.

The maximum withdrawal amount from ATMs is between 500 and 2.000 USD. The maximum is at Bred Bank ATMs at 2.000 USD.

Personal Experience

I tried to withdraw 620 USD from a BRED ATM, and the transaction failed, with no reason printed. This was because the ATM only dispenses 100 USD bills.

Then I tried 600 USD and it gave me 6 crisp new 100-dollar bills and charged me 604 USD (4$ fee).

What currency to withdraw – USD or KHR?

Assuming you are using a foreign bank card, almost all ATMs will only give you the option to withdraw USD.

You don’t want to withdraw Riel anyway:

- It’s a thicker stack of banknotes for the same value

- You will get a worse rate (wider margins) from your bank than for USD

But if you insist on directly withdrawing KHR, then find an ATM of ABA Bank or Mekong Bank – they may allow you to choose Riels (if they haven’t already removed the option completely). The withdrawal fees remain the same, though – bugger.

Withdrawal Fees

I hate paying ATM withdrawal fees. I’m not talking about the fees you get charged by your bank – those you can avoid by using a FinTech solution like Revolut, Curve, or Monese.

I’m talking about the so-called ATM access fees.

Unfortunately, all ATMs in Cambodia charge a withdrawal fee!

All ATMs in Cambodia charge a withdrawal fee between $5 and $10$. Ouch! I guess they stole the idea from their neighbors in Thailand, where ATMs also charge a similar amount.

MB Bank and Canadia used to charge 0 access fees but have since introduced 5$ fees per withdrawal.

Some ATMs (for example, Maybank) don’t say they will charge a fee, but then do!

Unfortunately, no matter how much you try, you cannot avoid the ATM access fee in Cambodia.

ATM with the lowest fees

The best ATM for foreigners in Cambodia and the one with the lowest fees is Bred Bank ABA Bank.

It charges $5 for withdrawals regardless of the amount. The single transaction limit is 500 USD, which isn’t great but isn’t too terrible either.

Bred Bank used to charge only $4 for up to $2000 per withdrawal, but has since upped this to a whopping $10. Still, if you withdraw more than $1000, it comes out to the same fee in percentage (1% or less for more withdrawn).

Beware of ATMs not telling you they charge fees when they indeed do! Wing Bank, for example, doesn’t disclose that it charges 5$ per withdrawal. Similarly, ABA ATMs don’t always disclose that you will pay a withdrawal fee, but you will!

Mekong Bank and Maybank used to offer free withdrawals, but do not anymore since late 2023.

Almost all ATMs will only dispense 100 USD bills. If you want smaller USD notes, try an Acleda ATM.

| Bank | ATM Access Fee | Withdrawal Limit |

| Bred | 10$ | 2000$ |

| Vattanac | 5$ | 500$ |

| ABA | 5$ | 500$ |

| Acleda | 5$ | 500$ |

| Canadia | 5$ | 500$ |

| Maybank | 5$ | 500$ |

| Mekong | 5$ | 500$ |

| Cathay United | 6$ | 500$ |

Exchanging Money in Cambodia

Given that Cambodia uses the US dollar just as much as its own currency, you don’t have to exchange your dollars for Cambodian riel. But you will save a little money if you do!

See, if you pay with USD, you will be given change back in KHR as if 1 USD is 4000 KHR. But if you exchange the USD first, you will get around 4100 KHR for each dollar. This amounts to around 2.5 extra dollars for every 100 USD!

If you use a currency other than USD, you should exchange it for KHR inside Cambodia if you’re sure you will have enough time to spend it. If unsure, change to USD – you can always change again to KHR.

Where to Exchange Money

Cambodia has one of the lowest exchange margins anywhere in the world. Seriously, have you ever seen an exchange margin of less than 0.1%? In Cambodia, that’s common!

To get such a good rate, exchange your money at:

- Jewelry Stores

- Phone Shops

- SuperRich (the super famous Thai exchange bureau)

- Street kiosks of banks (like Wing Bank above)

Other places where you can exchange your money:

- Banks (bureaucratic but reliable)

- Airports (worst rates)

- Hotels (bad rates)

- Tour Agencies (bad rates)

- Dodgy guy at the market (you’re setting yourself up to be scammed)

Tips for Changing Money in Cambodia

When you change money in Cambodia, be it USD or any other currency, note these tips:

- Higher denominations = higher rates;

- Damaged banknotes = lower rates + fee (if accepted at all);

- Don’t accept foreign banknotes with ANY damage (if changing Riel back to USD or receiving change in USD, for example);

Paying with KHQR (Money)

In August 2024, Cambodia launched an app called the Bakong Tourists App (Google Play and App Store), which allows foreigners to pay with the KHQR system.

It’s similar in concept to other QR code payment systems like the ones in China, Laos, or Indonesia.

To use it:

- Download and install the app.

- Enter your email address, name, and date of birth.

- Verify your email address by entering the 6-digit code you received.

- Top up your account.

- Scan the QR code at merchants that accept it (pretty much all in Cambodia), enter the amount, and pay.

How to top up your Bakong Tourist App Account

For now, you can only top up:

- At banks with cash

- At an ATM with cash

Either method has no fees associated with it.

There are plans to make it possible to top up by card (similar to how the BCEL app in Laos works) in the future. This may have a 1-3% fee. Stay tuned.

Common Scams

There is a reason why backpackers unaffectionately call it Scambodia.

I’d argue it’s on par with the scammers in Vietnam. Well, not everybody is a scammer – most locals in both countries are friendly and honest. But there are enough bad apples to necessitate this section. Here are some common money scams in Cambodia.

Foreign Money “Collectors”

He approaches you with some BS story about how he collects foreign money but somehow doesn’t have your 50 euro note. He offers to give you the equivalent amount in Riels. You think you are helping a numismatic complete his collection, but he’s actually screwing you over with the exchange rate because you aren’t used to the riel money yet.

Only exchange money at reputable businesses.

“I need small banknotes, do you mind swapping?”

He asks to take your 10s and 20s USD in exchange for a nice single 100$ banknote. He needs to change, alright. He could even be someone in charge, like the immigration officer or the guy who you pay for your visa on arrival.

You then try to spend this 100$ only to find out it has a fatal flaw – it’s torn and taped or has a cut or something else. Nobody in Cambodia wants to take it.

Always scrutinize US banknotes super carefully! Look at them under bright light and reject all banknotes with even the smallest cuts or creases.

Baby food

She stops you, baby in her hands, maybe crying even. The baby is hungry. She doesn’t want money – just baby food. Perhaps powdered milk.

You wouldn’t give her money, because who knows what she would spend it on? But baby food? Yeah, seems legit.

She then runs back to the store and returns it for cash. Which is, I bet, not going towards other baby food.

Stamping fee at the border

The immigration officer cheekily shows you a 5$ bill while you are waiting for him to stamp your passport, either entering or exiting Cambodia. You have already paid for a visa. What the mangoes is that fee?

It’s corruption, that’s what. It’s illegal, but border oversight is so weak in Cambodia that officers feel empowered to ask for money. And most people do give them something.

If you don’t give any, they will just stall and stall, making you wait longer at the border. It’s annoying.

I know it sounds risky, but my advice here is to make a scene. Pull out your phone and threaten to record a video. Tell them this is corruption and you won’t stand up for it. Show them this is not a proper way to greet (or wave goodbye to) tourists.

They will be embarrassed and will give up. After all, they are the ones breaking the law, and you’re the one who’s decided to spend money in their country.

How much cash to bring to Cambodia?

If you’re bringing US dollars, bring as much as you think you’d need.

If you’re bringing another currency, it doesn’t matter all that much if you use a card to withdraw directly or exchange your money for USD.

When I went to Cambodia, I had 300$, which was enough for 10 days. I paid for some things with a card (Angkor Wat, for example) and had some dollars left over at the end of the trip.

Example prices

Owing to the prevalent use of dollars, Cambodia is a bit more expensive than its neighbors in Laos, Thailand, and Vietnam. Nonetheless, it remains a relatively cheap country.

These are actual price ranges from 2024

- Noodle soup: 1.5-2.5$

- Chicken skewer on the street: 0.25-0.5$

- Fruit smoothie: 1-1.5$

- 1.5 L bottled water: 0.5$

- Can of beer (street bar): 0.25-1$

- Royal Palace + Silver Pagoda in Phnom Penh: 10$

- Killing Fields + audio guide: 6$

- Angkor Wat day ticket: 37$ (3-day pass is 62$)

- Visa: 30$ (e-Visa is 36$)

- Budget hostel: 3-7$

- Guesthouses: 8-12$

- Mid-range hotels – 20-45$

- Half-day group tour – 20-80$

- Travel Insurance from SafetyWing (covers you in Cambodia): ~22 USD for a 10-day trip.

Bargaining

The golden rule is to never accept the first offer in Cambodia.

Bargaining is a must.

The first price you will hear will almost always be at least double what the locals pay.

It’s not uncommon to get a price 10 times higher than the actual one, especially in touristy places.

As a foreigner, you will never get the locals’ price. But if you bargain playfully and politely, you can easily get at least a 50% discount most of the time.

Do not bargain in supermarkets, museums, and proper restaurants.

Do bargain at open-air markets, for taxis & tuk-tuks, street food, and guesthouses.

Tipping

Tipping is mostly not expected in Cambodia.

If you want to tip, do so. Go for 10-15% of the bill.

Trendier restaurants have started putting a 10% service tax, in which case, I would say tipping is a bit over the top.

Frequently Asked Questions

Let’s answer some of the most common questions about money in Cambodia.

Why does Cambodia use US dollars?

The short answer is that Cambodian people have historically had higher confidence in the US dollar than in the Cambodian Riel.

The longer answer involves a bit of history about the Khmer Rouge – a repressive and bloody regime that controlled Cambodia until 1979. Under it, Cambodia didn’t use money – almost all transactions were barter.

After the regime fell, foreign aid came into Cambodia in the form of US dollars. The people didn’t trust the new Rial currency, so they stuck to dollars. If you want to learn more, read about the dollarization in Cambodia.

It’s been like this ever since. However, things are starting to change. Cambodia is trying to de-dollarize and bring confidence back into the Riel. To what success, remains to be seen.

What is the ATM withdrawal limit in Cambodia?

ATMs commonly have a withdrawal limit of 500 USD, but BRED Bank ATMs have a limit of 2.000 USD for a single transaction.

Can you use US dollars in Cambodia?

The US dollar is an unofficial second currency in Cambodia, and you can pay for anything and everything using dollars.

The exceptions are that you cannot use coins, 2$ banknotes, old dollars (issued before 2009), or banknotes with any damage.

Can you use Revolut in Cambodia?

Yes, Revolut cards work in Cambodia. Both VISA and Mastercard work. You can withdraw from ATMs and pay at POS terminals with your Revolut card.

Similar fintech apps like Wise, Monese, Curve, N26, and Starling also work there.

If you are going to other Southeast Asian countries, you may want to read my money guides for them too:

- Tourist Guide to Money in Thailand

- Tourist Guide to Money in Vietnam

- Tourist Guide to Money in Laos

- Tourist Guide to Money in the Philippines

- Tourist Guide to Money in Myanmar

- Tourist Guide to Money in Malaysia

- Tourist Guide to Money in Timor Leste

- Tourist Guide to Money in Indonesia

Hi Simon

In Siem Reap they took $5 and $1 notes. Change would be dollars if they had them, otherwise riel. According to our Vietnam tour guide, the Cambodians don’t trust $2 notes as being real! Incidentally the Vietnamese are very happy to take dollars when giving a tip.

Regards Steve (Nov 25)

Confirming that BRED now charges $10 flat for Mastercard debit withdrawals instead of $4.

Please note that Bred Bank now charge $6 for Visa/UPI cards and $10 for Mastercard withdrawals.

Oh my, they have gotten quite greedy! 🙁

Bred have changed there fees from today it looks like, they charged me $10 to withdraw $400, I have heard varying charges from other users but I cant find a rate list, I have asked Bred to snd me one but it is Cambodia so I have my fingers crossed

Thanks very much!! I found this very informative for our upcoming trip (I am not well prepared for). Jane

Thank you for the tips !

good add to the article here : nomadfeesaver.com